Tax Configuration

SubSync can manage tax by mapping to Xero Tax Rates or by mapping to Xero Line Items, but which approach is best for you?

Xero Tax Rates are preferred by users that want to take advantage of the tax handling features built in to Xero - this is usually the case for users without complex sales tax environments. Users need to map their Stripe Tax Rates to their Xero Tax Rates in SubSync.

Xero Line Items are preferred by users with complex Tax environments (like the United States) where they would prefer to avoid mapping hundreds of tax rates, opting to send tax to Xero as a line item, which can then be post-processed by sales tax apps like Avalara (more detail here).

Either way, SubSync fully supports both Stripe Tax and Stripe custom tax approaches.

Xero Tax Rates

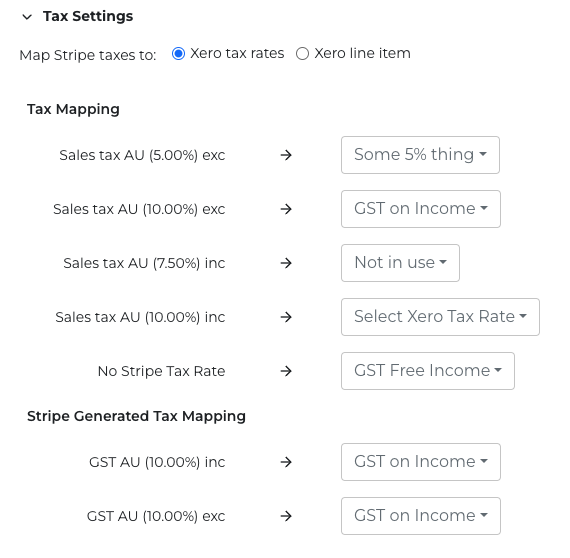

On the SubSync Settings page, in the Tax Settings section select the Xero Tax Rates option

You will be presented with a list of your Stripe Tax Rates on the left - this to separated into Stripe Tax Rates you have created in Stripe, along with any Stripe Generated Tax Rates that Stripe generated for you as a result of using the Stripe Tax feature. You can roll your mouse over the Stripe Tax Rate names to see their associated descriptions. Use the menus on the right to select your equivalent Xero Tax Rate (SubSync automatically retrieves these from Xero).

Select “Not in use” from the menu if you do not have an equivalent Xero Tax Rate and don’t intend to use the Stripe Tax Rate going forward. Note that the menu is filtered to only include tax rates that match the tax % between Stripe and Xero to avoid mismatches.

Press the Save Settings button when done.

Xero Line Items

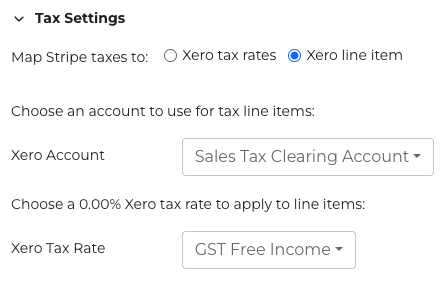

On the SubSync Settings page, in the Tax Settings section select the Xero Line Item option

Choose a Xero Account for the Tax Line Item, then select the Xero 0% Tax Rate that you would like your invoices to use (as the real tax will be applied later).

Press the Save Settings button when done.